“Love is patient and kind; love does not envy or boast; it is not arrogant or rude. It does not insist on its own way; it is not irritable or resentful; it does not rejoice at wrongdoing, but rejoices with the truth.” ~ 1 Corinthians 13:4-6

Google marriage and money. You will quickly discover that financial matters are one of the primary stress points for couples. Experts in study after study tell us that how a couple resolves money related disagreements is an indicator of a marriage’s success

Google marriage and money. You will quickly discover that financial matters are one of the primary stress points for couples. Experts in study after study tell us that how a couple resolves money related disagreements is an indicator of a marriage’s success

The topic of money came up frequently during discussions at Anchorpoint’s recent marriage workshop. Additionally, an entire evening’s curriculum session was devoted to money matters. This is a common issue that most couples either face or will face. In the Twogether Pittsburgh curriculum that was used for the workshop, five financial stumbling blocks are pointed out:

- I wish my partner were more careful about spending money. (72% of couples)

- We have trouble saving money. (72% of couples)

- We have problems deciding what is more important to purchase. (66%of couples)

- Major debts are a problem for us. (56% of couples)

- My partner tries to control money. (51% of couples)

In addition, did you know that according to Twogether Pittsburgh research we spend up to 80% of our waking hours earning money, spending money or thinking about money? Compound this with the understanding that people have different styles of spending and saving as well as experiences with money or lack thereof. What fuel for conflict without even factoring in other marriage related issues!

“In a marriage you are one half of a financial team,” says Cassy Wimmer, Anchorpoint Counseling Ministry’s Groups Facilitator. She encourages couples to discuss the challenges of this as well as why this can be helpful. Both spouses bring something valuable to the money discussion. Most folks are somewhere in between the extremes but do lean toward being a Spender or a Saver. There is some truth to the old adage that opposites attract so it is likely that a Spender and a Saver will be married together. This can cause difficulty and lead to disagreement. Cassy suggests that you learn and understand your partner’s style of spending and saving and talk about it. Failing to have discussions and make a financial plan is a major mistake according to Cassy. It will exacerbate other areas of conflict in a marriage relationship (selfish demands, disrespectful judgements, angry outbursts, dishonesty, annoying habits, independent behavior, etc.). She recommends that when having financial discussions with your spouse “put on your rose colored glasses, lower your defenses, and approach your partner with understanding.”

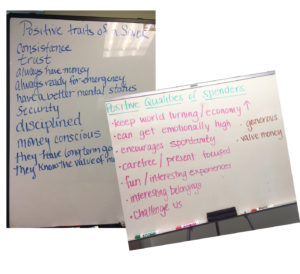

During a marriage workshop session on finances, Cassy had participants identify themselves as Savers or Spenders. She then divided them into two groups and had them make a list of the positives of each money style. “Which of these positive qualities about your spouse did you fall in love with when you first met?” Cassy asked them afterwards. This is good to remember when conflict arises.

During a marriage workshop session on finances, Cassy had participants identify themselves as Savers or Spenders. She then divided them into two groups and had them make a list of the positives of each money style. “Which of these positive qualities about your spouse did you fall in love with when you first met?” Cassy asked them afterwards. This is good to remember when conflict arises.

Cassy suggests that couples create a budget keeping the above sensitivities in mind. For couples that already have a budget, she recommends that each partner list three short-term financial goals and three long-term financial goals. Then, discuss whether or not your current budget will meet these goals, and if applicable, how to adjust your budget to reach these goals. You may find that you have to sacrifice some in order to reach others. There are so many benefits for a couple to creating a budget together. Cassy says that utilizing a budget is a positive tool and freeing for couples. It doesn’t have to be a constant battle. Dare we say it may even spark understanding and romance!

There are many great workshops, books, and other resources available on financial planning for couples. Friends, your pastor, or a financial planner may have a good recommendation for you. In addition, Cassy suggests two books that may help you and your spouse get onto the same page: Money and Marriage by Matt Bell or Your Money Map: A Proven 7-Step Guide to True Financial Freedom by Howard Dayton. Anchorpoint’s Executive Director, Rev. Dr. Ron Barnes, also suggests that couples may find Dave Ramsey’s (www.daveramsey.com) articles and books helpful. You can often find his Financial Peace University workshops hosted by local churches. In addition, Anchorpoint’s Parent Education Coordinator, Joan Schenker, offers a workshop called, The Family Economy: Chores and Allowances that has been helpful for parents in learning how to include their children in family budgeting and the role this discussion plays in boosting self-esteem and independence. “All of these resources are ultimately to help not only your finances but your relationship,” says Rev. Barnes.

There are many great workshops, books, and other resources available on financial planning for couples. Friends, your pastor, or a financial planner may have a good recommendation for you. In addition, Cassy suggests two books that may help you and your spouse get onto the same page: Money and Marriage by Matt Bell or Your Money Map: A Proven 7-Step Guide to True Financial Freedom by Howard Dayton. Anchorpoint’s Executive Director, Rev. Dr. Ron Barnes, also suggests that couples may find Dave Ramsey’s (www.daveramsey.com) articles and books helpful. You can often find his Financial Peace University workshops hosted by local churches. In addition, Anchorpoint’s Parent Education Coordinator, Joan Schenker, offers a workshop called, The Family Economy: Chores and Allowances that has been helpful for parents in learning how to include their children in family budgeting and the role this discussion plays in boosting self-esteem and independence. “All of these resources are ultimately to help not only your finances but your relationship,” says Rev. Barnes.

If you and your spouse are having difficulties discussing and agreeing on money matters or other areas in your marriage, Anchorpoint is available. Call us to schedule an appointment to meet with a compassionate professional therapist who can help you navigate areas of conflict and bring healing to your relationship. Call 412-366-1300 to arrange for marriage counseling today.